On this page

Overview

This section outlines the key elements, processes, and responsibilities of agencies to support the annual budget process.

It supports all public sector employees to understand the requirements associated with requesting amendments to approved budgets.

Budget development

Key points

- The budget process is the primary decision-making mechanism through which the NSW Government allocates public resources and seeks legal authorisation from Parliament through the Appropriation Act to spend public funds.

- The Treasurer is responsible under the Government Sector Finance Act 2018 (GSF Act) for the preparation and presentation of the budget papers and Appropriation Acts each year.

- While the appropriation authorises expenditure for the budget year only, the budget outlines the State’s financial estimates across the budget year and three subsequent years (“forward estimates”).

- Only urgent, unavoidable and unforeseen proposals may be considered outside of the annual budget process.

- The budget process is agreed by the Expenditure Review Committee (ERC) of Cabinet ahead of the budget cycle and can vary year on year.

- Detailed operational guidance is issued to the sector at the start of each budget cycle.

The annual budget is the NSW Government’s primary financial, economic, and policy report. It provides a comprehensive medium-term update on the fiscal and economic outlook of New South Wales.

Anchored by the government’s fiscal objectives, the annual budget process is the mechanism through which the government determines its funding priorities and the amount of public funds to be legally authorised by Parliament for spending through the Annual Appropriation Bill(s) (see Budget governance).

While the Annual Appropriation Act(s) authorises expenditure of monies from the Consolidated Fund for the budget year only, the budget outlines the State’s financial estimates across the budget year and three subsequent years (the forward estimates).

Beyond determining funding priorities, the annual budget aims to achieve several objectives:

- provide transparency to the Parliament and public on the allocation of public resources and the performance of programs, services, and projects that use these resources

- maximise the use of public resources by prioritising spending on services, programs and projects that provide the greatest benefit to the community

- detail a comprehensive strategy to manage expenditure, revenue and debt to maintain long-term fiscal sustainability

- identify and outline strategies to manage risks that could impact the State’s fiscal position or the delivery of commitments

- enable reviews of existing service and policy settings to ensure effectiveness and sustainability

- give effect to the objectives, targets, and principles of the relevant legislation (see Budget management and governance).

Division 4.1 of the Government Sector Finance Act 2018 (GSF Act) details requirements related to the annual budget, including timing for release and contents of the budget papers.

In New South Wales, the annual budget process is the primary decision-making process for all proposals with future or potential budget impacts, including expenditure, revenue, savings and tax changes, as well as variations to existing agency budgets. Proposals with budget impacts will generally only be considered outside of the budget process if they are urgent, unavoidable, or unforeseeable at the time of the budget, and cannot be accommodated within existing resources or be deferred to the next budget cycle.

While this part of the guidance focusses on the development of the annual budget, the overarching end-to-end budget cycle involves interlinked phases of planning, decision-making, delivery and monitoring and reporting. That is, as the next annual budget is being planned and developed, delivery of current budget continues and is monitored and reported on.

Further information on the financial reporting associated with the end-to-end budget cycle is outlined in Budget management and governance - Financial monitoring and reporting.

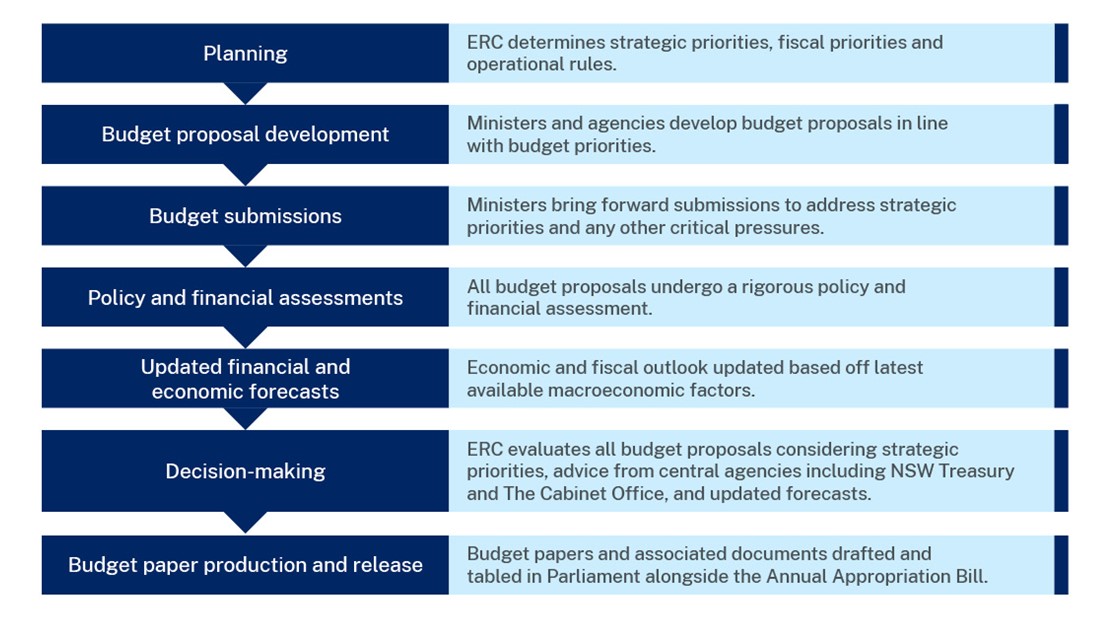

The annual budget process is structured into stages to facilitate the thorough evaluation and prioritisation of new and existing resources within the context of the economy, fiscal position and the government’s fiscal objectives. The process aims to ensure government resources are allocated effectively, with resource allocation decisions by ERC supported by sound evidence and subjected to rigorous assessments, in line with the NSW Government Investment Framework (see Investment and assurance frameworks).

It is NSW Treasury’s role to operationalise and oversee the annual budget process. Each year, Treasury provides advice on the fiscal and economic context, risks and pressures, and the management of the annual budget process. This includes supporting the Treasurer to seek agreement from ERC on the budget’s strategic and fiscal priorities, as well as the operational rules that underpin the process.

The annual process can take between six to nine months and typically comprises the following stages.

The precise timing and process for each budget cycle is determined by the Treasurer, the Premier, and ERC, subject to the provisions of the GSF Act, including sections 4.4 and 7.16. The cycle can depend on various factors including the political cycle, unforeseen external events (for example, the COVID-19 pandemic), and the fiscal and economic landscape.

Budget decision-making typically follows one of the two processes detailed in Figure 2.

A two-stage process refers to ministers submitting their budget proposals for consideration in two stages:

- Stage one: high-level consideration on the strategic alignment and fiscal impact of each proposal, and whether the proposal should be considered further. The outcome of stage one consideration will inform what proposals will be included in the final budget submissions. A proposal that is not approved to proceed to stage two is considered a final decision and will not advance further.

- Stage two: detailed consideration by ERC of all supported stage one budget proposals (including cost variations) through the budget ERC submissions, with a final decision regarding policy parameters and funding.

Detailed operational guidance setting out the timelines and requirements for the annual budget is distributed to agencies at the start of each budget cycle. NSW Treasury also provides agencies with the relevant templates to submit proposals for consideration.

Further information on requirements for submitting budget proposals is outlined below in Budget proposals.

As part of the annual budget process, the NSW Government has adopted an alternative budget management model to safeguard the independence of integrity agencies and ensure the delivery of their statutory objectives. As such, integrity agencies are subject to tailored requirements throughout the budget process.

Further information can be found in the Treasurer’s Direction TD24-12: Charter of Independence for NSW integrity agencies.

Budget proposals

Key points

- Budget proposals are categorised into new policies and cost variations. All proposals compete for the same resources and are assessed at the same time to enable a thorough discussion of trade-offs.

- A new policy proposal (also referred to as a “budget measure”) is a proposal put forward by ministers for the consideration by the government involving a new initiative or a discretionary change to existing policy.

- All new policy proposals must be supported by evidence and adhere to requirements as set out in the NSW Government Investment Framework (see Investment and assurance frameworks).

- A cost variation is a change to the budget of an existing program or service due to external factors which are beyond an agency’s control.

- Parameter and Technical Adjustments are a category of cost variation which involves adjustments beyond the control of an agency, such as increased demand or accounting changes.

- Carry forwards are a category of cost variation that enable an agency to transfer unspent funds from the current financial year to future financial years to meet the revised delivery schedule of a program or project.

- NSW Treasury conducts assessments on all budget proposals and provides advice to the government. This includes an assessment of the policy merits, value for money, economic merit and verification of the financial impacts.

The government is required to make resource allocation decisions based on the available evidence and options, considered within the context of limited resources. Budget proposals are a fundamental component of the annual budget development process, serving as the primary mechanism to inform the decision-making process.

Ministers, with the support of their agencies, can bring forward budget proposals for consideration during the annual budget process. Budget proposals not only outline the financial plans for programs, projects or services; they set out policy objectives, service delivery standards, milestones, delivery timeframes and performance indicators.

In doing so, budget proposals provide a basis for evaluating and prioritising resources and provide transparency on what the expenditure of public funds will achieve. This process supports the achievement of the objectives of the annual budget as set out above in Budget development.

Budget proposals are categorised to support decision makers to distinguish between the cost of new initiatives and the cost of continuing to deliver existing services, policies and projects. These categories are:

- new policies

- cost variations.

All proposals, regardless of their category compete for the same finite pool of funding. This competitive environment ensures that only the most critical and well-justified proposals are prioritised.

Budget proposals are only considered outside of the budget process if they are urgent, unavoidable, or unforeseeable at the time of the budget, cannot be accommodated within existing resources or be deferred. This ensures that all proposals are evaluated comprehensively, consistent with the government’s strategic priorities and fiscal strategy and enables a thorough discussion of trade-offs.

A new policy proposal is a request to approve a new initiative or a discretionary change to existing policy that requires an active decision by government. That is, a decision to modify or change an existing policy that is not due to external factors. These proposals can also be referred to as “budget measures”.

Ministers may bring forward proposals for new policies to be considered in the annual budget process. These proposals may address specific issues, improve public services or achieve strategic objectives. While new policies are typically associated with additional funding or a saving, there are circumstances where these proposals have no fiscal impact (e.g. regulatory change).

Table 1 outlines examples of the types of new policy proposals. Generally, if a proposal does not meet the strict criteria for a cost variation (see below in Cost variations under Budget proposals), then the proposal is considered a new policy.

| Recurrent |

|---|

|

| Capital |

|

| Other |

|

New policy proposals must be developed in line with the NSW Government Investment Framework (see Investment and assurance frameworks) and any other requirements outlined in detailed operational guidance issued by NSW Treasury annually. These requirements ensure that proposals are aligned with strategic priorities, are deliverable, well costed and demonstrate clear evidence of impact.

Agencies should engage with NSW Treasury early when developing a budget proposal with significant policy and financial impacts. This helps ensure that a proposal is aligned with government priorities and provides valuable feedback to determine if it is worthwhile committing resources to develop a business case.

In addition to engaging with NSW Treasury, additional consultation is required when developing certain types of new policy proposals, outlined in Table 2.

| Category | Requirement for consultation and/or engagement |

|---|---|

| Cross-portfolio | All relevant agencies and ministers. |

| Taxation | NSW Treasury, Revenue NSW, the Minister for Finance, and the Treasurer on all proposals that result in a change to State taxation revenue arrangements. |

| Capital investment | NSW Treasury and Infrastructure NSW prior to submission of the Gate 0 Review (project initiation phase) for proposals with an estimated value of $100 million or more. |

| ICT investment (including Cyber Security) | The Department of Customer Service on all ICT Investment proposals, and Cyber Security NSW on all Cyber Security proposals. |

| All proposals | First Nations peoples and communities must be consulted where it is clear there is an impact on these peoples or communities arising from the proposal. Refer to Investment and assurance frameworks. |

Processes relating to industrial relations proposals and Commonwealth-State funding agreements are outlined below in Approval of negotiating parameters.

Further information on new policy proposals can be found in TPG21-11: Parameter and Technical Adjustments and New Policy Proposals (Measures).

Once a policy, program or project has been approved, there may be external factors beyond an agency’s control that may vary the cost or timing of the originally approved budget.

As outlined in A vision for strong budget and financial management, agencies and ministers are expected to proactively manage pressures associated with existing services and projects prior to seeking new funding. As such, in the first instance agencies will be expected to identify mitigating actions to avoid impact on the State’s budget or identify internal funding sources to meet these cost pressures. These steps must be taken prior to approaching government for further funding.

If a risk or pressure associated with the delivery of an existing service or program cannot be managed internally, a request for a cost variation can be submitted for consideration by ERC during the budget process.

The objective of cost variations is to ensure the integrity of the budget and enhance transparency regarding the cost and timing of delivering existing policies and services. They allow the government to review policy settings for existing programs, services and projects and determine whether these settings remain appropriate given the changes in delivery costs and timing.

They are not intended to replace accurate cost estimates at the proposal stage or accurate forecasting of revenues during the annual budget process.

The categories of cost variations are outlined in Table 3.

| Variation | Description and examples |

|---|---|

| Parameter Adjustment | A Parameter Adjustment is a change to the budget of an existing program, service or project in response to external factors which has altered the cost of delivery. The adjustment enables the continued implementation of initiatives when there are obligations or legal requirements to meet delivery, and a change in service provision is not possible. Examples include:

|

| Technical Adjustment | Technical adjustments are non-discretionary changes made to budgets of existing programs, services or projects to reflect appropriate accounting standards, update timing of spend, or reflect changes in the technical aspects of financial management. Examples include:

|

| Carry Forward | A Carry Forward enables an agency to transfer unspent funds (budget control limits) from the current financial year to future financial years to meet the revised delivery schedule of a program or project. This occurs when unforeseen events impact the delivery timeframes of a program or project. Carry forwards are only granted in a limited set of circumstances. For example, a delay in construction due to significant wet weather. |

All cost variation proposals are subject to Treasury assessment of the justification and Treasurer or ERC approval. Requests will be considered against a range of factors including policy settings and objectives, delivery timeframes and overall agency financial performance.

Further information on Parameter and Technical Adjustments can be found in TPG21-11: Parameter and Technical Adjustments and New Policy Proposals (Measures).

Further information on Carry Forwards can be found in TPG22-05: Carry Forwards Policy.

As the primary adviser to ERC and the NSW Government on all fiscal and economic matters, NSW Treasury will undertake an assessment of all budget proposals (new policy proposals and cost variations) and provide advice to support government decision-making. These assessments ensure that proposals offer the best value for taxpayers, while balancing consideration of policy efficacy and the government’s service responsibilities.

The NSW Government Investment Framework (see Investment and assurance frameworks) guides agencies through the process of developing comprehensive evidence to support informed resource allocation decisions. The evidence developed in compliance with these requirements enables a detailed assessment of all budget proposals and provides a comprehensive evidence base to support decision-making.

Each assessment undertaken by NSW Treasury will be tailored to the proposal. However, at a high level, NSW Treasury’s assessment will encompass:

- Policy: verifying that the proposal clearly articulates the problem to be solved, how it will address the problem identified and assessing alignment with the government’s strategic objectives. This includes evaluating various options available to government to achieve the stated objective or policy options to manage cost pressures associated with an existing program, service or project.

- Financial: verifying that costs reflect the true and efficient cost of delivering the proposal. This includes verifying the breakdown of costs, the underlying assumptions used to model the financial impacts of the proposal and/or options (for example, economic assumptions that drive demand for a service), that staffing costs are appropriate and the profile of financial impacts is achievable. Financial assessments also consider an agency’s financial performance and the ability to manage additional costs internally or delivery constraints.

- Value for money: analysing the costs and benefits of the proposal and assessing the net benefit that the proposal presents to the community. This includes assessing whether existing resources should be reallocated as the proposal presents greater value for money than an existing project, service or program.

While the approach to value for money and financial assessments will largely remain stable over time, policy assessments are likely to vary to ensure ongoing alignment with the government’s annual budget strategic priorities.

Agencies are required to undertake detailed costings to inform the financial impacts of all budget proposals (new policies and cost variations) for the duration of the proposal, or over a 10-year period (budget year, forward estimates and six planning years) if the proposal is ongoing. The costing must identify the impacts on key fiscal metrics – expenses, revenue, budget result, capital, net lending and net debt.

Capital and ICT proposals must include the whole of life costs of a project, including the associated operational expenses, depreciation and maintenance requirements. This information is captured in the Financial Impact Statement which is a required component of each budget cabinet submission.

Detailed and accurate costings of all financial impacts are essential to decision-making. The identified impacts on key fiscal metrics inform decision-makers about the trade-offs involved in each decision and enables the tracking of impacts on the government's fiscal strategy.

They are also essential for budget integrity. Ensuring that all policy settings, delivery timeframes and corresponding financial impacts are reflected in the budget aggregates means that the public and financial markets can have confidence that government policy is fully funded. Accurate costings in the development stage of a proposal prevent the likelihood of overspends and underspends occurring throughout the life of the proposal.

Costings must in turn be verified by NSW Treasury using a costing method agreed between the agency and NSW Treasury. NSW Treasury assurance of the costing is a pre-requisite for ERC consideration of budget proposals. As such, early engagement between policy and finance functions within agencies is strongly encouraged.

Alongside costing requirements, all budget proposals must include detailed workforce impacts, including information on key occupations, grades, plus executive and non-executive breakdowns. When seeking additional employee expenses, information also needs to be provided to determine if there are any reprioritisation opportunities with existing workforces, attraction and retention issues or ongoing vacancies/excess employees.

The NSW Government has made a policy decision to reduce and limit the growth in several categories of expenditure. When developing and costing proposals, agencies must ensure that new staffing and spending across these categories is transparent to NSW Treasury and are supported by a clear rationale. These expenses include:

- senior executive staff

- labour hire and other contractors

- consultants

- travel

- advertising

- external legal expenditure.

Budget improvement measures, reallocations, and expenditure reviews

Key points

- All ministers and agencies are required to support the government to meet its fiscal targets and optimise the use of finite resources through the identification of savings, revenue, reform and reprioritisation opportunities.

- The government may initiate a budget and expenditure review, which is an in-depth assessment of an agency’s functions, programs and activities.

- To support the implementation of savings and reforms, agencies may request funding from NSW Treasury to support redundancy payments. This may only occur after all mobility policies and guidelines have been complied with.

- Certain funding is protected and can only be used for its intended purpose unless the Treasurer grants written approval. Unused protected funds must be returned to the budget.

As outlined in Budget governance, the NSW Government has committed to several fiscal targets. All ministers and government agencies are required to contribute to these targets. Ministers and agencies are expected to actively reprioritise existing budgets and identify opportunities for savings prior to seeking new funding.

If it is not possible to implement a proposal in a budget neutral way and additional funding must be sought, a full explanation must be provided and verified by NSW Treasury. If the explanation is unsatisfactory, or the offsetting measures presented are not genuine or practical, the proposal may need further evidence to be considered.

Genuine savings, revenue or offsets are deliberate policy decisions which improve the budget and forward estimates position through:

- reducing expenditure below the level of expenditure currently included in the budget estimates

- ceasing programs that are not effectively achieving outcomes or in line with government priorities

- undertaking upfront investment to deliver longer term efficiencies or savings (i.e. digitisation opportunities)

- increasing revenue (both taxation and non-taxation) above that currently included in the budget estimates.

Examples of non-genuine savings include fortuitous underspends, avoided costs and the deferral of existing expenses. All savings must be fully costed and verified by NSW Treasury prior to consideration by ERC.

Budget and expenditure reviews are conducted under direction from the government to identify opportunities for budget improvement measures, savings, reforms and efficiencies through an in-depth assessment of agency functions, programs and activities.

Agency budget reviews are an important financial management tool in the support of financial accountability, transparency and value for money in the use of public funds.

The primary objectives of agency budget reviews are to:

- inform resource allocation and re-prioritisation decisions for agency budgets, including trade-offs within and across portfolios

- improve minister and agency accountability for transparent and effective resource allocation and re-prioritisation

- inform program spending baseline and policy parameters for ongoing expenditure.

Budget reviews can identify opportunities to:

- raise own source revenue or appropriately cost recover activities

- reduce the cost of program delivery through better design and scope

- improve service delivery efficiency and effectiveness, and

- streamline processes and structures.

Consideration may be given to several factors when identifying and prioritising reviews. This may include the prevalence or emergence of budget risks and financial pressures, or sustained budget control breaches, the agency’s financial performance, and the nature of activities undertaken i.e., discretionary or core service delivery and level of government control over the drivers of expenditure.

To support the implementation of workplace changes which may be required to achieve savings programs, agencies can apply to NSW Treasury for support with redundancy payments.

Prior to determining that an employee is excess and seeking redundancy payment support, agencies must comply with:

- NSW Government Sector Workforce Mobility Placement Policy which sets out the requirements for agencies in the non-executive employee placement process

- Senior Executive Mobility Guidelines which provide guidance to agencies for priority assignment of senior executive employee mobility requirements.

Mobility of employees across the public sector is a high priority for the NSW Government. Mobility ensures that talented public sector employees are not lost from the sector unnecessarily, resources are effectively mobilised across the sector to meet government priorities, and redundancy costs are limited.

After complying with the above policy and guidance, agencies may proceed with implementing a redundancy program under the Premier’s Memorandum M2011-11: Changes to the Management of Excess Employees.

In accordance with TPG23-23: Funding for Redundancy Payments, agencies can then apply to NSW Treasury for reimbursement of the cost of redundancy payments. Applications to NSW Treasury must be accompanied by relevant supporting material. This includes a Premier’s Department concurrence to a redundancy program for non-executives.

Although agency budgets should be considered holistically to manage pressures and deliver on outcomes, the exception is when expenditure is protected. Protected items are funds allocated for specific purposes and cannot be used or repurposed without approval from the Treasurer or ERC, including any underspends.

Protected items may include:

- uncontrolled expenditures i.e. a demand driven rebate program

- first year funding for new policies

- projects or programs with conditional approval

- programs funded through accounts created in the Special Deposit Account under legislation for a specific purpose (SDA account)

- expenditure on programs funded by the Australian Government through National Agreements and National Partnerships.

Generally, funding amounts under $2 million are not protected. However, in some circumstances smaller items such as contributions to interjurisdictional agreements may be protected.

If a minister and agency wish to use funding allocated to a protected item for another purpose, including using underspends, the responsible minister must seek approval in writing from the Treasurer to reallocate the funds. This request may be referred to ERC for consideration.

Further information can be found in TC12/10: Protected Items and Funds.

In addition to the circular, SDA account money may be transferred between SDA accounts in limited circumstances (in accordance with section 10.3B of the GSF Act) but cannot otherwise be repurposed for a purpose inconsistent with the SDA account’s enabling legislation.

Approval of Negotiating Parameters

Key points

- Cabinet must review and endorse any proposals that create a legal, financial, contingent, or other commitment for the NSW Government.

- The Council on Federal Financial Relations, of which the NSW Treasurer is a member, is responsible for all Commonwealth-State funding agreements.

- Where new or renegotiated Commonwealth-State agreements have a budget impact or are high value/high risk, ERC approval must be sought for negotiating parameters prior to commencing formal negotiations with the Commonwealth.

- The NSW Government Fair Pay and Bargaining Policy 2023 guides the negotiation of pay and conditions across the public sector, including the identification of productivity enhancing reforms and/or cost savings in exchange for higher wages.

- Bargaining parameters outside of the Government’s sector-wide offer will need approval from the Senior Officials Wages Advisory Committee (SOWAC) and ERC.

As outlined in Section 3.2 – Budget proposals, ERC must review and evaluate all proposals that have future or potential budget impacts. Cabinet endorsement is also required for any proposals that create a legal, financial, contingent or other commitment for the NSW Government.

For any proposals that have a financial impact, including those that create liabilities for the NSW Government, ERC endorsement must be obtained before any engagement begins. This includes the approval of parameters required for industrial relations, Commonwealth-State funding agreements, commercial negotiations (including unsolicited proposals) and legal settlements.

This ensures that proposals are thoroughly assessed for their financial implications and alignment with government priorities, mitigating potential risks and ensuring effective and efficient use of government resources.

Commonwealth-State funding agreements and industrial relations proposals are subject to additional requirements, which are detailed further in the following sections.

In 2020, National Cabinet determined that the Council on Federal Financial Relations (CFFR) will be responsible for all Commonwealth-State funding agreements. This arrangement was formalised under the Intergovernmental Agreement on Federal Financial Relations (IGAFFR), which also sets out a framework for Commonwealth payments made to states to support service delivery, infrastructure provision and reforms. The IGAFFR recognises the primacy of state and territory responsibility in service delivery, however, also recognises that coordinated action is necessary to address Australia’s social and economic challenges.

Through CFFR, Treasurers will agree whether Treasurers or ministers will be responsible for negotiating and signing upcoming agreements. This decision is undertaken on a case-by-case assessment of policy, budgetary, precedent and other potential risks associated with the agreement.

Generally, the NSW Treasurer will negotiate and sign the most significant funding agreements and all those within the NSW Treasury portfolio. Ministers will have responsibility for the negotiation and signing of most funding agreements related to their respective portfolios. Once CFFR has agreed the responsible minister to manage the agreement, the responsible Commonwealth department will commence formal drafting of the agreement and seek to enter into negotiations with state agency counterparts.

NSW Cabinet has overall responsibility for approving Commonwealth-State funding agreements on behalf of the NSW Government, however there are instances where this may be delegated, as outlined below. Where new or renegotiated agreements have a budget impact, ERC approval must be sought for negotiating parameters prior to agencies or ministers entering into formal negotiations with the Commonwealth. If negotiating parameters change or only in-principle agreement was given to a position, the minister or Treasurer must return to ERC to seek further approval.

Where there is no budget impact, the Treasurer has authority to sign an agreement if they are the designated signatory. If the portfolio minister is required to sign the agreement, approval to enter into the agreement must be obtained by an exchange of letters with the Treasurer, except for the instances below where responsible ministers can enter into an agreement without pre-approval:

- Commonwealth-State funding agreements which are low-value and low-risk, with the Commonwealth funding to New South Wales up to $20 million over the life of the agreement or $5 million in a single year; and

- Where a matched or co-contribution is required from New South Wales by the Commonwealth, the portfolio agency proposes to meet the additional funding from its existing budget, or funding has already been pre-approved by ERC.

Agencies should discuss upcoming agreements with NSW Treasury and The Cabinet Office to determine potential budget impacts and the appropriate approval pathway.

Further information on funding agreements can be found in the TC22-14: Commonwealth-NSW Funding Agreements.

In 2023, the NSW Government updated legislation to facilitate negotiation of changes to pay and conditions across the public sector, abolish the public sector wages cap and introduce mutual gains bargaining as a cooperative industrial relations framework. The NSW Government Fair Pay and Bargaining Policy 2023 guides the implementation of the new approach.

Under the revised framework, the NSW Government will agree bargaining parameters for a sector-wide pay offer. Agencies may propose bargaining parameters that include enhancements to pay and conditions above the pay offer, however in exchange, agencies must identify productivity enhancing reforms and/or cost offsets.

When agencies seek to table bargaining parameters outside of the NSW Government’s pay offer, agencies must ensure proposals are reviewed by the Senior Officials Wages Advisory Committee (SOWAC) and approved by ERC before commencing negotiations. If proposed increases to remuneration or other conditions of employment are consistent with the NSW Government’s policy and pay settings, SOWAC may approve the proposals.

All bargaining parameters which are above the NSW Government’s pay offer must be supported by evidence, risk mitigation strategies and have robust costings. Consistent with a new policy proposal, NSW Treasury must verify the financial or other impact of the enhanced offer, including associated cost savings, productivity reforms or efficiencies.

Final bargaining positions must be approved by SOWAC and/or ERC before arrangements can be finalised. There may be instances where ERC approval is sought on revisions to bargaining parameters multiple times throughout the course of a negotiation.

Last updated: 08/05/2025