Purpose

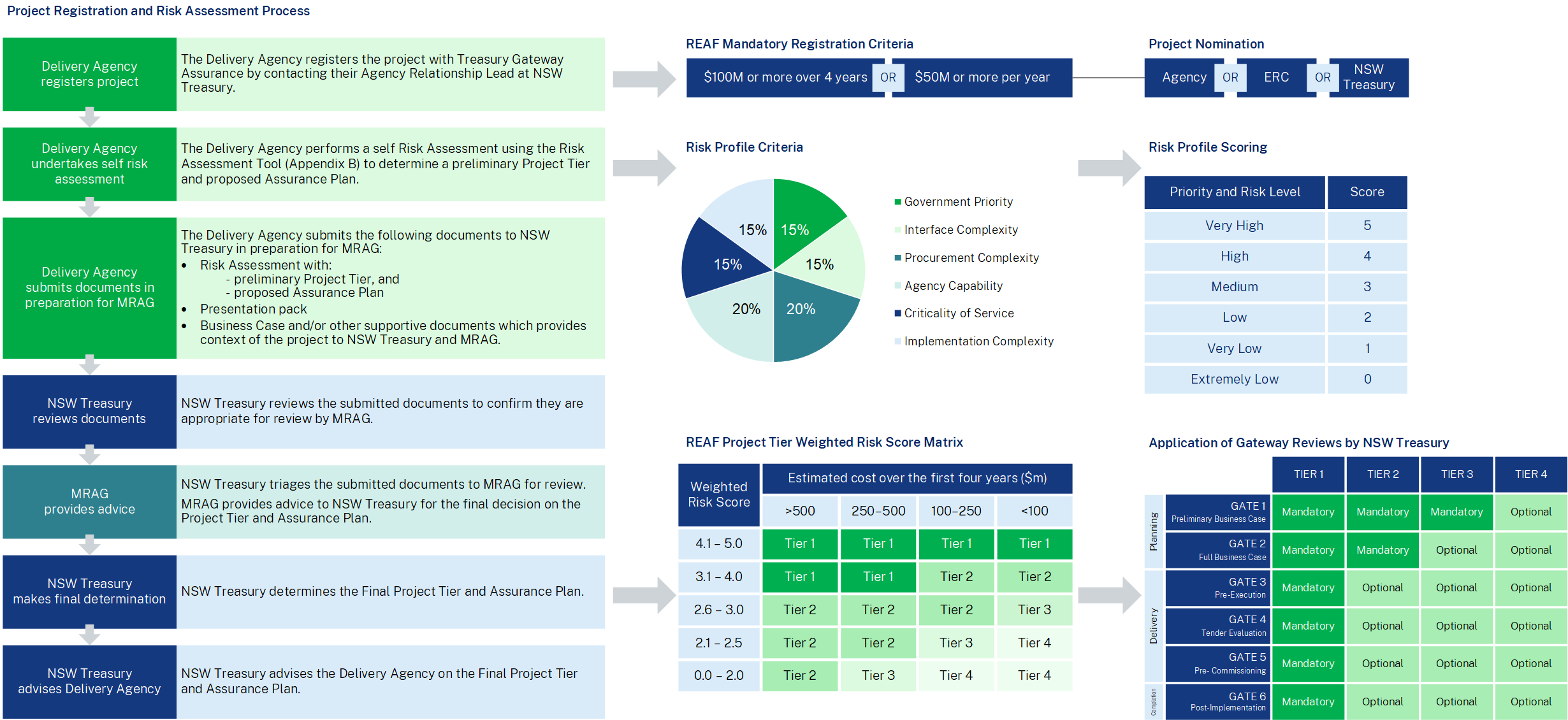

The Recurrent Expenditure Assurance Framework (REAF) is an independent risk-based assurance process for the State’s Major Recurrent Expenditure Projects. It is established under the NSW Gateway Policy and is approved by the NSW Government.

The objective of the REAF is to provide assurance that the Government’s Major Recurrent Expenditure Projects across NSW are delivered on time and on budget by implementing this risk-based external assurance framework. The REAF will also ensure that the Cabinet Standing Committee on the Expenditure Review (ERC) is supported by effective tools to monitor the NSW Government’s major new policy proposals, receives early warning of any emerging issues, and can therefore act proactively to increase project success.

Risk-based approach

The REAF uses a risk-based approach to assign each project a risk tier. This tiered approach is designed to strike the right balance between a robust approach, correctly focused on the highest risks, and achieving value for money. This ensures that the right level of assurance is applied to each project.

Who needs to comply?

The REAF applies to all Major Recurrent Expenditure Projects being developed and/or delivered by Government agencies, Government Businesses, and State Owned Corporations (to the extent made applicable under TPP18-05 Major Projects Policy for Government Businesses or any successor policy).

What are Major Recurrent Expenditure Projects?

All recurrent expenditure projects that meet one of the following criteria are required to register:

- Projects valued at an Estimated Total Cost (ETC) of equal or greater than $100 million over the first four years or $50 million in any one year

- Projects nominated by ERC, NSW Treasury, or the Delivery Agency.

If they meet the above criteria, they are Major Recurrent Expenditure Projects and are subject to the REAF regardless of the funding source.

When to register?

Upon determining that a project qualifies as a Major Recurrent Expenditure Project, it will need to be registered with NSW Treasury Gateway Assurance as early as possible. This applies at any stage of the project’s lifecycle.

How to register?

If you would like to register or discuss your Major Recurrent Expenditure Project, please email our Treasury Gateway Assurance team: [email protected]. Once you've met with the team and we’ve confirmed your project’s eligibility, we will guide you through registration.

What are the benefits?

REAF Assurance Reviews provide independent and experienced advice within a confidential environment, sharing outcomes between the NSW Government and the Delivery Agencies.

Assurance Reviews add value for the Delivery Agency by assisting the successfully deliver of projects through identifying key risks and making practical recommendations accordingly.

Assurance Reviews are structured so as not to delay the development or delivery of projects.